Infrastructural deficit: Ehanire, Izuwah, others call for policies to boost investors’ confidence

To address Nigeria’s infrastructural deficit, government must adopt proactive legislation and ensure transparency in accessing relevant information to boost investors’ confidence

This was the submission of stakeholders, at a plenary session on Infrastructural Development Imperatives of Edo Economic Development Agenda, at the Alaghodaro Investment Summit in Benin City, Edo State.

Minister of State for Health, Dr. Osagie E. Ehanire, who was a participant at the session, said the federal government intends to build investors’ confidence by strengthening institutions and processes.

Dr. Ehanire said, “all levels of government should be interested in expanding critical infrastructure by developing legislative frameworks to guarantee investors return on investment. This will enable them to build infrastructure that will fast-track economic growth.”

The minister urged the Edo state government to ensure the passage of legislative frameworks to open up the space for investment in social infrastructure.

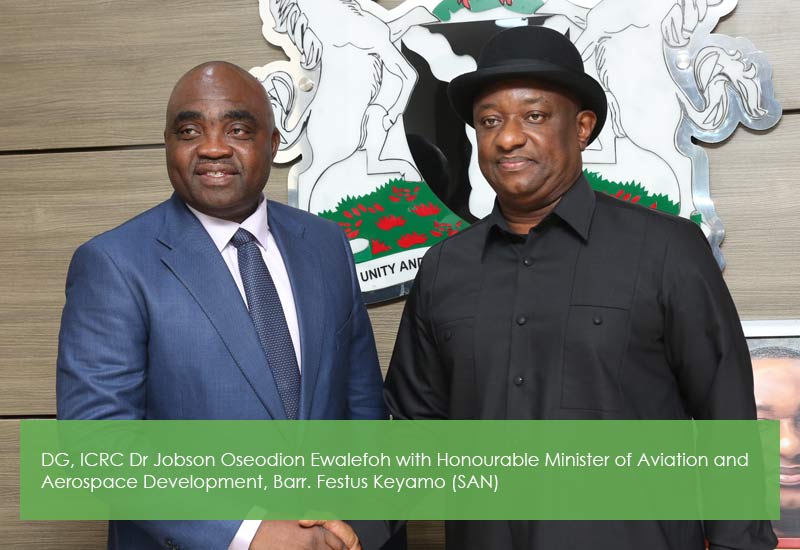

Director General, Infrastructure Concession Regulatory Commission (ICRC), Chidi Izuwah, stressed on the need for the state government to collaborate with the federal government in reducing the country’s infrastructural deficit, noting that when it was necessary government should declare a state of emergency on the infrastructure sector.

He added that state governments cannot address the challenge of infrastructure without a legal framework, stressing the need to ensure discipline and good governance.

He applauded the initiative of the Edo State Government in implementing the Public Private Partnership (PPP) agency, adding that the move will boost investors’ confidence.

“The creation of the sub-national PPP resource centre will boost investment. It will address the challenge of infrastructure shortfalls in the country,” he added.

Founding and Managing Partner, Perchstone and Graeys, Osaro Eghobamien spoke on the need for the state government to deal with uncertainty and the culture of kickbacks relating to attracting investors, noting, “information and a roadmap that will enable investors to identify investment opportunities in infrastructure sector in the state should be easily available on various communication platforms.”

Akiniyemi Osinubi of International Finance Corporation (IFC), called for the creation of regulatory agency and framework to guarantee returns on investment, which is one of the elements considered by investors in the infrastructure sector.

According to Osinubi “any investor who is coming to invest in infrastructure is on the lookout for structures that will guarantee he or she get returns from projects.”